Digital Banking

Online Banking

Enjoy the convenience of banking anytime, anywhere with secure online access to your accounts through Online Banking from MBT.

- Check your account balances

- Transfer funds

- View statements

- Search transaction history

- Make loan payments

- Pay bills

- Create and Manage Real-Time Alerts*

- Find locations

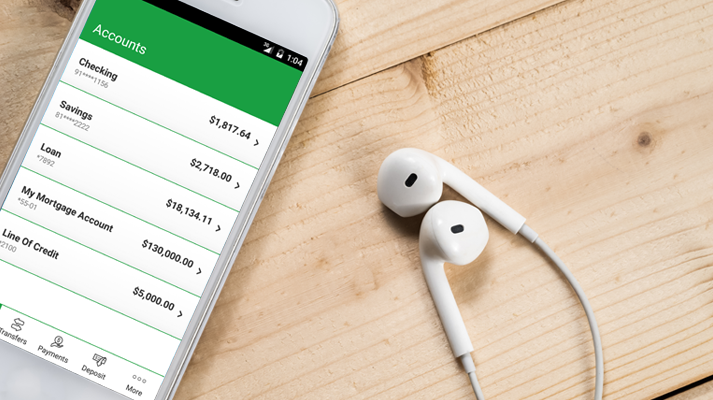

Mobile Banking*

Access your accounts at anytime, anywhere with our mobile app. Take control of your finances and do everything on your schedule.

- Check your account balances

- Transfer funds

- Create, manage, and receive Real-Time Alerts

- Make loan payments

- Pay bills

- Deposit checks

- View account history and more

Frequently Asked Questions

You may login to your Digital Banking account via our online banking or mobile banking app. When you first login, you will be asked to verify your identity using a registered mobile number or email address. You may then select to receive a one-time-passcode (OTP) via text message, phone call, or email that you will need to enter to proceed with your identity verification which will unlock access to your digital profile.

Once your identity has been verified, you will then be provided an option to enroll (or reenroll) your mobile device to accept biometric authentication such as Face ID or fingerprint to use these biometric login security measures.

We encourage you NOT to enroll a non-personal, temporary, or public device/computer. If you must login to your Digital Banking using someone else's device, laptop, tablet, or pc, or any public computer, you will be prompted to select a method to receive an OTP. In these situations, unless it is new, personal, or other trusted hardware, do not choose to recognize these devices, browsers, etc. in order to preserve the security of your login.

Your Current Balance is the actual (ledger) balance in your account as calculated at the end of all nightly processing. It reflects all transactions posted to your account through the previous business day. Current Balance is not updated throughout the day and does not reflect any holds on deposits or authorized amounts for debit card purchases that are pending.

Your Available Balance is the amount of money in your account available for your use. Your Available Balance is calculated by adding or subtracting transactions from your Current Balance as they are received throughout the day. These transactions may include direct deposits, debit card transactions, pre-authorized transactions, ATM withdrawals, in-person deposits and withdrawals, and more.

However, please note that your Available Balance isn't necessarily how much you have to spend. If you have written any checks, scheduled bill pay payments, or authorized other automatic payments, your available balance may not yet reflect these items.

Items not reflected in your Available Balance include, but are not limited to:

- Checks written or issued through Bill Pay that haven't been cashed by the Payee.

- Pay-at-the pump transactions or restaurant tips that aren't included in the original authorization.

- Authorized automatic withdrawals, such as insurance or car payments, gym memberships, subscriptions, etc.

- Authorizations that no longer appear as pending due to merchant delay.

- Funds held from deposits.

Please visit with your Banker if you have any questions about your accounts, balances, or transactions.

Your Digital Banking include additional security and identity verification measures. This includes multi-factor authentication which uses a combination of your login and password, device/computer authorization, and one-time-passcodes (OTPs) to protect your Digital Banking information and verify your identity.

For most customers, you can access all your accounts related with your primary account ownership at MBT. It is possible you may see additional account(s) that you are authorized to view but would prefer not to have included in your profile. If this happens, please contact us to assist you in customizing your account view was needed.

To set up alerts and notifications, choose Menu in the upper right-hand corner, select Settings, Beacon Alerts, and Accept Terms. You may add, view, or modify new alerts at any time, so we encourage you to set up alerts and settings to be sure you are receiving these important notifications. For more information visit Beacon Alerts.

Yes! You may view up to 60-days of transactions history and E-Statements once enrolled, for an unlimited time period. Your digital banking services even include access to more electronic documents, including tax documents.

Yes! Connections to such third-party financial management tools as Intuit/Quicken, Mint or Plaid, etc. are available. However, if you have any issues with any of these connections, please contact the third-party solution provider for assistance.

You may choose to match both your online and mobile banking theme to your local United Community Banks brand: United Community Bank, Mercantile Bank, Liberty Bank, Marine Bank & Trust, Brown County State Bank, Farmers State Bank of Camp Point, or United Commonwealth Bank. To select your community theme, choose Menu in the upper right-hand corner, select Settings, Profile, and Change Your Theme. You are not required to change or select a new theme, and should you choose to do so, you may change it at any time. Your default profile theme includes all of our United Community Banks!

Our E-Services Team is available to assist you, toll-free, by calling 877-610-4628 Monday-Friday 7:00 a.m. - 6:00 p.m. CT and Saturday 8:00 a.m. - 12:00 p.m. CT. They will be glad to help answer your questions, address any issues you may have, and assist you.

You may also contact or visit your Banker or any location for assistance during normal business hours. Visit our Locations page to find the location closest to you which also includes phone numbers and hours for each of our banks.

* Your cellular provider's data and text messaging rates may apply to mobile Digital Banking Services including Mobile Banking, Mobile Deposit, Mobile Wallet, Zelle®, Card Controls, and Beacon Alerts activities.